Introduction

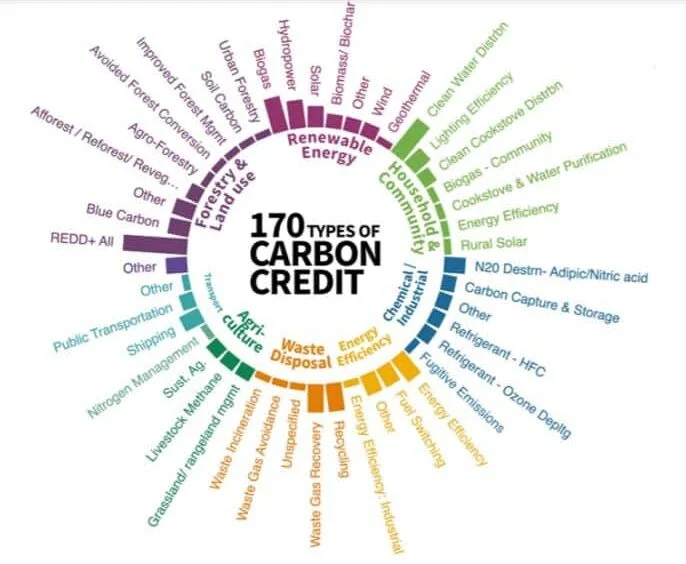

As climate change accelerates, the global community has recognized the need for immediate and sustained action to reduce greenhouse gas (GHG) emissions. Carbon credits have emerged as a key tool in this effort, providing a market-based mechanism to incentivize the reduction of carbon emissions. India, as one of the world’s largest economies and a significant emitter, plays a critical role in the global carbon market. This essay explores the role of the Indian government in promoting carbon credits, the significance of India’s Nationally Determined Contributions (NDCs) under the Paris Agreement, the legal and regulatory challenges in the Indian voluntary carbon market, and future policy directions for carbon credits in the country.

The Role of the Indian Government in Promoting Carbon Credits

The Indian government has been instrumental in promoting carbon credits as part of its broader strategy to address climate change. The government’s involvement can be seen through several key initiatives and policies aimed at fostering the development and trading of carbon credits.

- Regulatory Frameworks: The Indian government has established various regulatory frameworks to encourage the generation and trading of carbon credits. The Perform, Achieve, and Trade (PAT) scheme, for instance, is a flagship program that incentivizes energy-intensive industries to improve their energy efficiency. Companies that exceed their energy efficiency targets can earn Energy Saving Certificates (ESCerts), which are tradable and can be used to meet future obligations or sold to other entities.

- Clean Development Mechanism (CDM) Projects: India has been an active participant in the Clean Development Mechanism (CDM) under the Kyoto Protocol, which allows developed countries to invest in emission reduction projects in developing countries and earn carbon credits. The Indian government has facilitated the approval and implementation of numerous CDM projects, making India one of the largest suppliers of Certified Emission Reductions (CERs) globally.

- National Action Plan on Climate Change (NAPCC): Launched in 2008, the NAPCC outlines India’s strategy to address climate change through eight national missions, including the National Solar Mission and the National Mission for Enhanced Energy Efficiency. These missions have led to the development of several carbon credit-generating projects, particularly in the renewable energy and energy efficiency sectors.

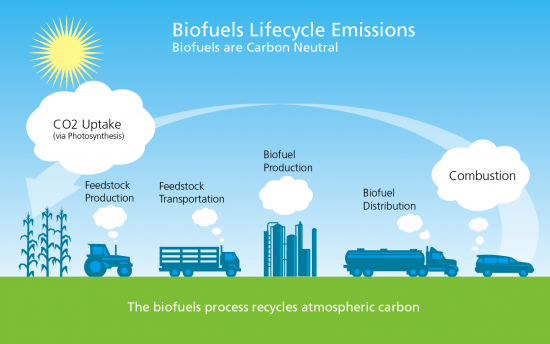

- Promotion of Renewable Energy: The Indian government’s ambitious targets for renewable energy, particularly solar and wind, have indirectly supported the growth of carbon credits. By promoting large-scale renewable energy projects, the government has created opportunities for the generation of carbon credits, contributing to the overall reduction of GHG emissions.

Understanding India’s Nationally Determined Contributions (NDCs) and Carbon Markets

India’s Nationally Determined Contributions (NDCs) under the Paris Agreement represent the country’s commitment to reducing its carbon footprint and contributing to global climate goals. The NDCs set specific targets for reducing GHG emissions, increasing renewable energy capacity, and enhancing carbon sequestration through forest and land use management.

- NDC Targets: India’s NDCs include a commitment to reduce the emissions intensity of its GDP by 33-35% by 2030, compared to 2005 levels. Additionally, the country aims to achieve 40% of its installed electricity capacity from non-fossil fuel sources by 2030 and to create an additional carbon sink of 2.5 to 3 billion tonnes of CO2 equivalent through afforestation and reforestation activities.

- Role of Carbon Markets: The carbon market plays a crucial role in helping India achieve its NDC targets. By creating a market for carbon credits, the government can incentivize industries to invest in low-carbon technologies and renewable energy projects. The trading of carbon credits also provides a mechanism for companies to offset their emissions and contribute to the country’s overall emission reduction goals.

- Linkage with International Markets: India’s participation in international carbon markets, such as the CDM and potential future mechanisms under Article 6 of the Paris Agreement, can further support the achievement of NDC targets. By selling carbon credits in global markets, India can attract investment in climate-friendly projects and generate revenue that can be reinvested in sustainable development initiatives.

Key Legal and Regulatory Challenges in the Indian Voluntary Carbon Market

Despite the progress made in promoting carbon credits, the Indian voluntary carbon market faces several legal and regulatory challenges that need to be addressed to ensure its effectiveness and scalability.

- Regulatory Uncertainty: One of the key challenges in the Indian voluntary carbon market is the lack of a clear and consistent regulatory framework. While the government has introduced various schemes and policies to promote carbon credits, the absence of a unified national carbon market has led to fragmentation and uncertainty. This has made it difficult for market participants to navigate the regulatory landscape and has hindered the growth of the voluntary market.

- Standardization and Quality Control: Ensuring the quality and credibility of carbon credits is crucial for the success of the voluntary market. However, the Indian market faces challenges related to the standardization and verification of carbon credits. There is a need for robust mechanisms to validate and certify carbon credits to prevent the issuance of low-quality or fraudulent credits.

- Market Demand and Liquidity: The Indian voluntary carbon market is still in its nascent stages, with limited domestic demand for carbon credits. This has led to low liquidity in the market, making it challenging for project developers to find buyers for their credits. Additionally, the lack of awareness and understanding of carbon credits among potential buyers has further constrained market growth.

- Legal Enforcement: The enforcement of contracts and agreements in the voluntary carbon market poses a significant challenge. In the absence of a strong legal framework, disputes between buyers and sellers over the quality or delivery of carbon credits can be difficult to resolve, leading to a lack of confidence in the market.

Future Policy Directions for Carbon Credits in India

To address the challenges and harness the full potential of carbon credits, the Indian government needs to adopt forward-looking policies and regulatory measures that can support the growth of both the compliance and voluntary carbon markets.

- Establishment of a National Carbon Market: One of the key future policy directions for India is the establishment of a unified national carbon market. This would involve the creation of a centralized platform for the trading of carbon credits, with standardized rules and regulations governing the market. A national carbon market would enhance transparency, increase market liquidity, and provide a stable environment for carbon trading.

- Strengthening Regulatory Frameworks: The government should focus on strengthening the regulatory frameworks governing the carbon market, particularly in terms of quality control and verification. Introducing stringent standards for the validation and certification of carbon credits would help build trust in the market and attract more participants.

- Incentivizing Domestic Demand: To boost the domestic demand for carbon credits, the government could consider introducing incentives for companies to purchase and use carbon credits. This could include tax benefits, subsidies, or the integration of carbon credits into corporate social responsibility (CSR) programs. Additionally, raising awareness about the benefits of carbon credits among businesses and consumers would help increase market demand.

- International Collaboration: India should continue to engage in international carbon markets and explore opportunities for collaboration with other countries. Participating in global carbon trading mechanisms, such as those under Article 6 of the Paris Agreement, would provide access to new markets and investment opportunities, further supporting India’s climate goals.

- Capacity Building and Awareness: Building capacity among stakeholders, including government agencies, businesses, and project developers, is essential for the success of the carbon market. The government should invest in training and education programs to enhance the understanding of carbon credits and market mechanisms. This would help create a more informed and capable market, capable of scaling up to meet the country’s climate objectives.

Conclusion

The Indian government has played a pivotal role in promoting carbon credits, contributing to the country’s efforts to address climate change. However, the voluntary carbon market in India faces several challenges that need to be addressed through robust policies and regulatory measures. By establishing a national carbon market, strengthening regulatory frameworks, and incentivizing domestic demand, India can unlock the full potential of carbon credits and make significant progress toward its climate goals. As the global focus on climate action intensifies, India’s proactive engagement in the carbon market will be crucial in shaping a sustainable future.

Leave a Reply