Carbon Credit Pricing by Type of Projects

As the world grapples with the challenges of climate change, carbon credits have emerged as a pivotal tool in the global effort to reduce greenhouse gas emissions. These credits, which represent a reduction or removal of one metric ton of carbon dioxide or its equivalent, can be bought and sold in various markets, offering a financial incentive for organizations to invest in sustainable practices. However, the pricing of carbon credits is not uniform and varies significantly depending on the type of project that generates them. This essay explores the factors that influence carbon credit pricing across different types of projects, shedding light on the complexities and dynamics of this emerging market.

1. Nature-Based Solutions

Nature-based projects, such as reforestation, afforestation, and soil carbon sequestration, are among the most well-known sources of carbon credits. These projects are highly valued because they offer co-benefits beyond carbon sequestration, such as biodiversity conservation, water purification, and soil restoration. Due to these additional environmental and social benefits, credits from nature-based solutions often command higher prices in the market. For instance, reforestation projects that restore degraded lands or protect endangered species habitats may attract premium prices because they contribute to multiple Sustainable Development Goals (SDGs) simultaneously.

However, the pricing of credits from nature-based solutions can be influenced by several factors, including project location, scale, and permanence. Projects in regions with high deforestation rates, such as the Amazon rainforest, may generate more expensive credits due to the urgency of protecting these critical ecosystems. Additionally, the scale of the project matters; larger projects that sequester significant amounts of carbon are often more cost-effective, leading to more competitive pricing. Finally, the issue of permanence—ensuring that the carbon sequestered remains stored for a long period—is crucial in determining the price, as projects with higher risks of reversal may be less valued.

2. Renewable Energy Projects

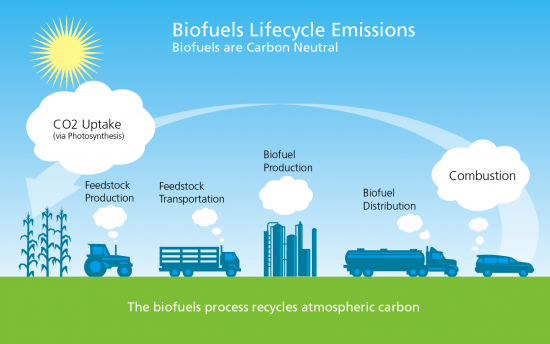

Renewable energy projects, including wind, solar, and hydroelectric power, are another major source of carbon credits. These projects reduce carbon emissions by displacing fossil fuel-based energy generation with cleaner alternatives. The pricing of carbon credits from renewable energy projects tends to be lower compared to nature-based solutions, primarily because they do not offer as many co-benefits. However, they are still vital in transitioning to a low-carbon economy.

Several factors affect the pricing of credits from renewable energy projects. The maturity of the technology plays a significant role; more established technologies like wind and solar tend to generate lower-priced credits due to the economies of scale and lower operational risks. In contrast, emerging technologies or projects in less developed regions may command higher prices due to the additional risks and costs involved. Furthermore, the local regulatory environment can influence pricing; projects in regions with supportive policies and subsidies may offer cheaper credits, while those in less favorable regulatory environments might be more expensive.

3. Energy Efficiency and Industrial Projects

Energy efficiency projects, such as upgrading industrial processes, retrofitting buildings, and improving transportation systems, generate carbon credits by reducing the energy required to perform the same tasks, thus lowering emissions. Industrial projects, including methane capture from landfills and waste-to-energy initiatives, also fall into this category. These projects often produce lower-cost credits because they typically involve well-established technologies and processes that are easier to implement.

The pricing of carbon credits from energy efficiency and industrial projects is influenced by factors such as the type of technology used, the scale of the emissions reductions, and the cost of implementation. Projects that utilize cutting-edge technologies or achieve significant emissions reductions may generate higher-priced credits. Additionally, the complexity and capital intensity of the project can affect pricing; large-scale industrial projects that require significant upfront investment may offer more expensive credits to reflect the higher costs involved.

4. Carbon Capture, Utilization, and Storage (CCUS) Projects

Carbon Capture, Utilization, and Storage (CCUS) projects involve capturing carbon dioxide emissions from industrial sources or directly from the atmosphere and either storing it underground or using it in various applications. These projects are essential for achieving deep decarbonization in sectors where emissions are hard to eliminate, such as cement, steel, and chemical production. The pricing of carbon credits from CCUS projects is generally higher due to the technological complexity, high capital costs, and the significant potential for long-term emissions reductions.

The cost of CCUS credits can vary depending on factors such as the source of the captured carbon, the method of storage or utilization, and the scale of the project. For instance, capturing carbon directly from the air (direct air capture) is more expensive and generates higher-priced credits compared to capturing emissions from a point source like a power plant. Additionally, projects that store carbon permanently underground may offer higher-priced credits due to the long-term nature of the solution, while those that use captured carbon in products may generate lower-cost credits depending on the market value of the end products.

5. Social and Community-Based Projects

Social and community-based projects, such as improved cookstove initiatives, water purification systems, and sustainable agriculture practices, generate carbon credits by reducing emissions at the household or community level. These projects often have a strong focus on improving local livelihoods and contributing to social development, making their credits attractive to buyers who prioritize social impact.

The pricing of carbon credits from social and community-based projects is influenced by the scope of the project, the level of community involvement, and the perceived social benefits. Projects that have a broader impact, such as those that improve health outcomes or enhance economic opportunities for marginalized communities, may command higher prices. Additionally, the level of community engagement and ownership can affect pricing; projects that are more participatory and inclusive may be valued more highly in the market.

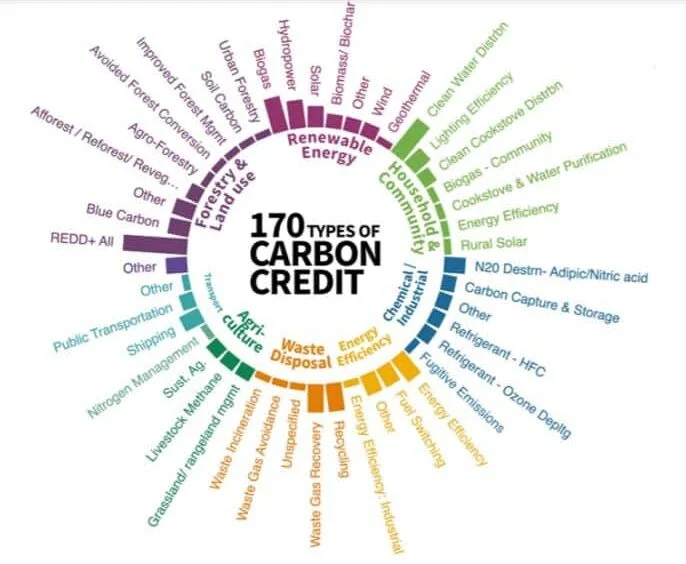

Carbon Credit Pricing by Type

There are many ways to value a carbon credit, whether using market dynamics, basing it on the cost of implementation, or the value that the project delivers. Pricing can also vary by project type, size, location, and other determining factors.

The chart below shares a basic snapshot of the pricing of various types of credits within the marketplace.

Source: Carbon Credit Pricing Chart: Updated September 2023 (8billiontrees.com)

Harnessing Carbon Credits to Heal the Planet

Carbon credits and offsets might seem complex, from their inception to their pricing, but they offer a tangible opportunity to encourage businesses and other key players to invest in something crucial: the health of our planet.

Human society relies on the Earth’s natural resources and balanced ecosystems to function. Therefore, despite their complexity, carbon credits provide a straightforward solution: restoring these ecosystems and curbing further emissions.

Through carbon offsets, both businesses and individuals can engage in this emerging market while contributing to the restoration of habitats for endangered species, improving water quality, and reducing harmful greenhouse gases in the atmosphere—helping to slow down global warming.

Conclusion

Carbon credit pricing is a complex and multifaceted issue that varies significantly depending on the type of project generating the credits. Nature-based solutions, renewable energy, energy efficiency, CCUS, and social projects all contribute to the global effort to reduce emissions, but each comes with its own set of factors that influence pricing. Understanding these dynamics is crucial for both buyers and sellers in the carbon market, as it enables them to make informed decisions that maximize both environmental impact and financial returns. As the market for carbon credits continues to evolve, the ability to accurately assess and price these credits will be key to unlocking their full potential in the fight against climate change.

Leave a Reply