Introduction

Carbon credit pricing and market dynamics have gained significant attention globally as nations strive to mitigate the impacts of climate change. India, being one of the largest emerging economies, plays a crucial role in the global carbon market. The country’s approach to carbon credit pricing and its market dynamics is influenced by various factors, including government policies, market demand, and international obligations. This essay delves into the intricacies of carbon credit pricing and the evolving market dynamics in India, highlighting the challenges, opportunities, and future prospects.

Understanding Carbon Credits

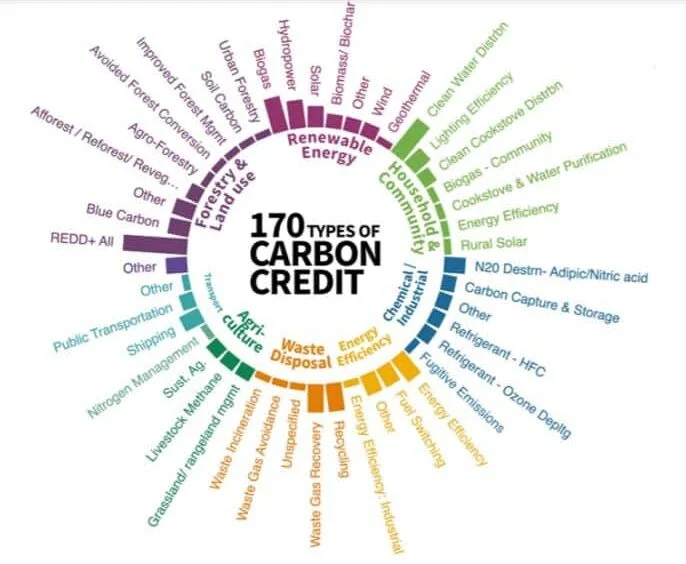

Carbon credits are permits or certificates that allow the holder to emit a certain amount of carbon dioxide or other greenhouse gases (GHGs). One carbon credit typically represents the right to emit one tonne of carbon dioxide or its equivalent. The concept was introduced as a market-based mechanism to reduce global carbon emissions, encouraging companies and governments to invest in cleaner technologies.

There are two main types of carbon markets: the compliance market and the voluntary market. The compliance market operates under mandatory national, regional, or international regulations, while the voluntary market allows businesses and individuals to purchase carbon credits to offset their emissions voluntarily. India participates in both markets, with a growing emphasis on the voluntary market.

Carbon Credit Pricing in India

Carbon credit pricing in India is influenced by several factors, including international market trends, government policies, and the demand-supply balance within the country. The pricing of carbon credits in India has been relatively lower compared to developed countries, primarily due to the abundant supply of credits and limited domestic demand.

The price of carbon credits in India is determined by factors such as:

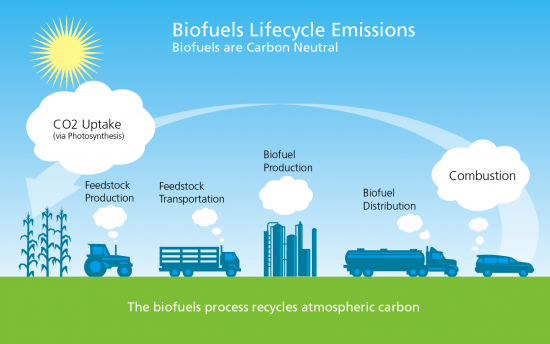

- Supply and Demand: The availability of carbon credits in India is largely driven by projects that reduce carbon emissions, such as renewable energy initiatives, energy efficiency projects, and reforestation programs. However, the demand for these credits is still growing, leading to lower prices in the domestic market.

- Government Policies: The Indian government has introduced various policies to regulate and promote the carbon market, such as the Perform, Achieve, and Trade (PAT) scheme, which aims to improve energy efficiency in energy-intensive industries. These policies have a direct impact on the pricing of carbon credits by influencing both the supply and demand sides.

- International Market Influence: India’s carbon credit market is also influenced by international carbon markets, especially through the Clean Development Mechanism (CDM) under the Kyoto Protocol. The global price of carbon credits affects domestic prices, particularly for credits generated by projects that are eligible for international trading.

Market Dynamics in India

The market dynamics of carbon credits in India are shaped by a complex interplay of domestic and international factors. Some key aspects include:

- Regulatory Environment: The Indian government has been actively involved in shaping the carbon market through regulations and initiatives. For instance, the National Action Plan on Climate Change (NAPCC) and the introduction of the National Carbon Market are significant steps towards creating a robust carbon trading system in India. These regulations aim to create a conducive environment for carbon trading and encourage investment in low-carbon technologies.

- Corporate Participation: Indian companies are increasingly recognizing the importance of carbon credits, both as a compliance requirement and a corporate social responsibility (CSR) initiative. Large corporations, particularly in energy-intensive sectors, are investing in carbon reduction projects to generate credits, which they can trade or use to meet their emission reduction targets.

- International Partnerships: India has been an active participant in international carbon markets, particularly through the CDM. Indian projects have generated a significant number of carbon credits, which are sold in international markets, bringing in revenue and contributing to global emission reduction efforts.

- Challenges and Opportunities: Despite the growing interest in carbon credits, the Indian market faces several challenges, including regulatory uncertainties, low domestic demand, and fluctuating international prices. However, there are also significant opportunities, particularly with the increasing global focus on climate change and the potential for India to become a major player in the carbon market.

Future Prospects

The future of carbon credit pricing and market dynamics in India looks promising, with several developments on the horizon. The government’s commitment to achieving its Nationally Determined Contributions (NDCs) under the Paris Agreement will likely drive further growth in the carbon market. Additionally, the expansion of renewable energy projects, advancements in clean technologies, and increased corporate participation are expected to boost the demand for carbon credits.

Moreover, the potential establishment of a national carbon market in India could lead to more standardized pricing mechanisms and increased transparency in the trading process. This would not only help stabilize prices but also attract more investors to the market.

Conclusion

Carbon credit pricing and market dynamics in India are evolving rapidly, driven by a combination of domestic policies, international market trends, and corporate participation. While there are challenges to be addressed, such as regulatory uncertainties and low domestic demand, the opportunities for growth are substantial. With continued government support and increased awareness among stakeholders, India has the potential to become a leading player in the global carbon market, contributing significantly to global efforts to combat climate change.

Leave a Reply