Report Summary

Ar per a report released by Polaris market research global voluntary carbon credit market size was valued at USD 1,908.41 million in 2023. The voluntary carbon credit industry is projected to grow from USD 2,388.76 million in 2024 to USD 14,560.17 million by 2032, exhibiting a compound annual growth rate (CAGR) of 25.3% during the forecast period (2024 – 2032).

The voluntary carbon credit market is witnessing significant growth as more companies commit to ambitious net-zero emissions targets. By purchasing carbon credits, businesses can offset emissions that are difficult to eliminate, fueling the expansion of the voluntary carbon market. This trend is also bolstered by consumers increasingly favoring eco-friendly products and brands, prompting companies to invest in carbon credits to bolster their sustainability efforts.

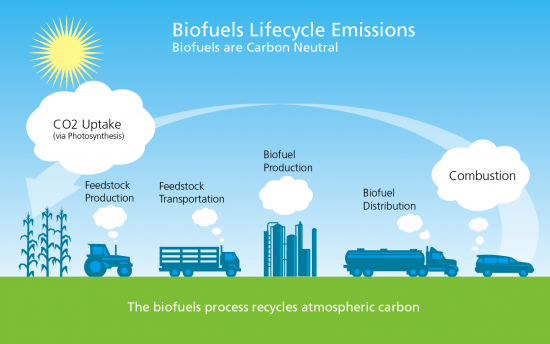

Voluntary carbon credits enable businesses, organizations, and individuals to offset their carbon emissions by buying credits from projects that reduce or remove greenhouse gases from the atmosphere. Unlike mandatory carbon markets, which are government-regulated, the voluntary market is driven by the desire to take proactive climate action and demonstrate environmental responsibility.

Key Market Stats:

- The global voluntary carbon credit market size was valued at USD 1,908.41 million in 2023.

- The market for the voluntary carbon credit industry is expected to grow from USD 2,388.76 million in 2024 to USD 14,560.17 million by 2032.

- It is expected that the market will exhibit a compound annual growth rate (CAGR) of 25.3% during the forecast period (2024 – 2032).

Major Findings From the Report:

- As various companies buy carbon credits to achieve greenhouse gas emissions, the market for voluntary carbon credit experiences robust growth. In addition, to meet consumer requirements for eco-friendly products and brands, organizations are investing in carbon credits to improve their green credentials.

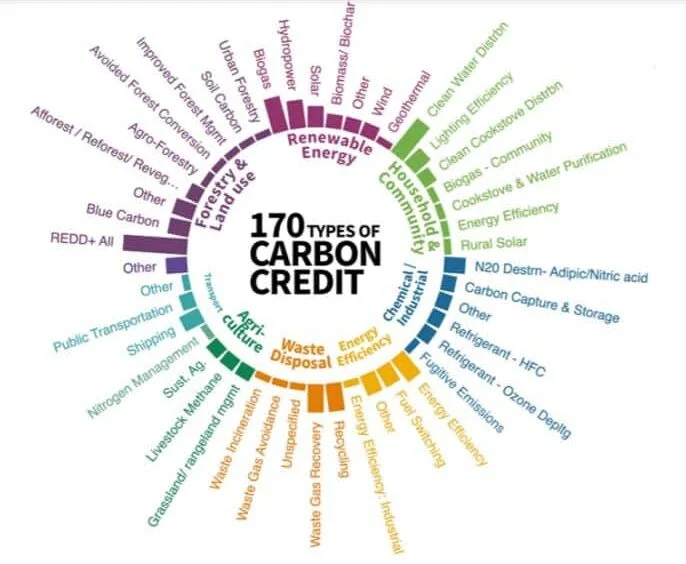

- The market is segregated by project type, end-user, and region.

- Based on region, North America recorded the largest share.

Market Drivers And Trends:

- Advanced Projects: The rising activities towards advanced projects such as carbon capture and storage (CCS), soil carbon sequestration, and blue carbon projects fuel the voluntary carbon credit market growth.

- Technological Developments: Increasing technological advancements in monitoring, reporting, and verification technologies to augment the accuracy and transparency of carbon credit projects further accelerate the market growth. Also, market accessibility has been eased due to the development of online marketplaces and exchanges that provide carbon credits to purchase, sell, and trade.

- Demand for Carbon Offset Projects and Related Credits: Another factor supporting the market growth is the growing demand for carbon offset projects and related credits. Various factors, such as consumer preferences, regulatory pressures, and corporate sustainability goals, are contributing to the voluntary carbon credit market demand.

- Favorable Government Policies: The introduction of new policy guidelines to support high-quality carbon offset projects boosts the market growth. For instance, the US government introduced new policy guidelines for the voluntary carbon credit market in 2024. The aim was to ensure the high integrity of voluntary carbon markets (VCMs) by updating standards.

To Understand More About this Research: Request a Free Sample Report

Leave a Reply